As a hedge fund manager, understanding and capitalizing on emerging trends like sustainable aviation fuels (SAF) offers a pathway to significant returns for investors. The aviation sector, known for its heavy reliance on fossil fuels, is now at a pivotal juncture where environmental sustainability meets economic opportunity. Here’s how investing in SAF can be lucrative:

Identifying Market Potential

- Demand Growth: The global push for reducing carbon emissions has airlines committing to ambitious net-zero targets by 2050. This commitment inevitably increases the demand for SAF, which can reduce lifecycle greenhouse gas emissions by up to 80% compared to traditional jet fuel. Hedge funds can invest in companies poised to meet this growing demand, like Neste or SkyNRG, which are already scaling up their SAF production capabilities.

- Regulatory Incentives: Governments worldwide are setting mandates for SAF blending, offering tax credits and subsidies to producers. The U.S. Inflation Reduction Act, for example, includes substantial tax incentives for SAF producers. These incentives can significantly lower production costs, making early investments in SAF ventures potentially very profitable as the market scales.

Investment Strategies

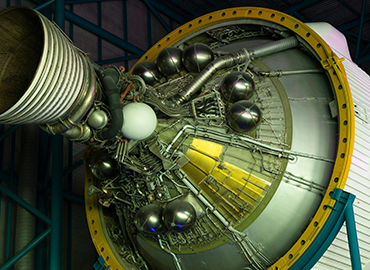

- Direct Investment in Producers: Investing directly in companies that produce SAF, like LanzaJet or Fulcrum BioEnergy, can be highly beneficial. These companies are at the forefront of converting waste or agricultural residues into fuel, which not only reduces emissions but also provides a sustainable business model as traditional feedstocks like oil become less viable due to environmental pressures.

- Venture Capital in SAF Startups: Smaller, innovative startups in the SAF space might offer high growth potential. By funding new technologies or processes, such as those developed by Viridos or Air Company, hedge funds can gain exposure to potentially disruptive innovations that could lead to high returns if successfully commercialized.

- Equity in Airlines Investing in SAF: Some airlines, like United Airlines through its Ventures arm, have set up funds specifically to invest in SAF. Investing in or alongside these funds or directly in such airlines can ensure a stake in both the demand and supply side of the SAF market.

Hedging Against Fossil Fuels

- Shorting Traditional Jet Fuel: As SAF gains traction, traditional jet fuel might see reduced demand, affecting companies solely reliant on fossil fuels. Hedge funds can use this transition to short sell stocks of companies like ExxonMobil or Shell that haven't diversified into SAF, betting on a market correction as sustainable alternatives take market share.

- Long on SAF-related Infrastructure: Investing in the infrastructure needed for SAF, such as specialized refineries or distribution networks, can be a smart move. Companies like bp, with its investments in SAF infrastructure, might benefit from this shift, providing a dual benefit of environmental impact and financial return.

Market Speculation and Policy Arbitrage

- Policy Changes: Anticipating or reacting swiftly to policy changes can yield significant profits. For instance, if new regulations favoring SAF are announced, hedge funds can adjust their portfolios to capitalize on the resultant market movements, either through direct investments or through financial instruments like futures or options related to aviation fuel.

- Global Market Opportunities: Different regions are at different stages of adopting SAF. Investing in or trading around regional discrepancies in SAF adoption and policy can lead to arbitrage opportunities. For example, Europe's aggressive SAF mandates might make European producers or investors in SAF more lucrative than those in regions with slower policy adoption.

Risk Management

- Diversification: The SAF market is nascent and carries risks, including technological, regulatory, and market acceptance risks. A diversified approach, investing in various aspects of the SAF ecosystem, from production to end-use, can mitigate these risks.

- Monitoring Technological Advances: Continuous monitoring of technological developments in SAF production, like the use of hydrogen or electrofuels, can inform timely investment decisions, ensuring the fund stays ahead of the curve.

Conclusion: The transition to sustainable aviation fuels is not just an environmental necessity but also an economic opportunity for hedge funds. By strategically positioning investments across the SAF value chain, from production to policy-driven demand, a hedge fund can not only contribute to decarbonizing aviation but also generate substantial returns for investors. The key lies in understanding the intricacies of this emerging market, leveraging policy shifts, and balancing the portfolio between high-risk, high-reward ventures and more established players in the field.